Are you looking for a simple and rewarding way to earn extra cash online? Pinecone Research might just be the opportunity you’ve been searching for! This exclusive survey platform connects you with innovative brands to share your opinions and shape the future of products and services—all while earning fantastic rewards.

What is Pinecone Research?

Pinecone Research is a trusted and well-established survey company known for providing members with paid opportunities to give feedback on a wide range of products. From testing out new ideas to evaluating existing ones, your insights play a critical role in shaping the market—and you get rewarded for your time.

Unlike many other survey platforms, Pinecone Research maintains a high standard of quality and exclusivity. Membership is invite-only, which ensures a better experience for participants. This exclusivity also means higher rewards per survey, with payouts ranging from £3-£5 per completed survey.

Why Join Pinecone Research?

Here are some of the top reasons to consider signing up:

- Reliable Payments: Pinecone Research offers prompt and secure payments through PayPal, bank transfer, or gift cards. You can trust that your efforts will be rewarded.

- Exclusive Access: Members often get the chance to test new products before they hit the market, giving you a sneak peek at upcoming trends.

- High-Quality Surveys: Unlike platforms that inundate you with irrelevant surveys, Pinecone Research ensures you’re matched with surveys that suit your profile.

- No Guesswork: They’ll notify you when surveys are available, saving you time and hassle.

- Build a Side Income: While Pinecone Research won’t replace a full-time job, it’s a great way to earn extra money for your opinions.

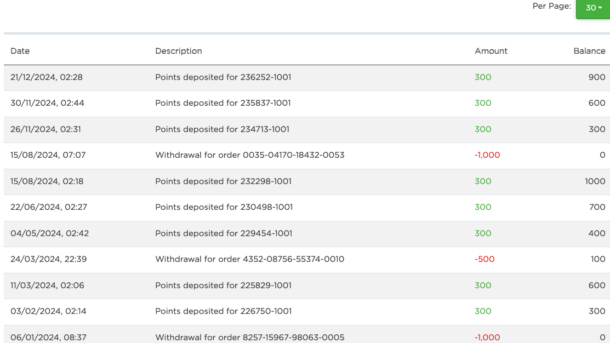

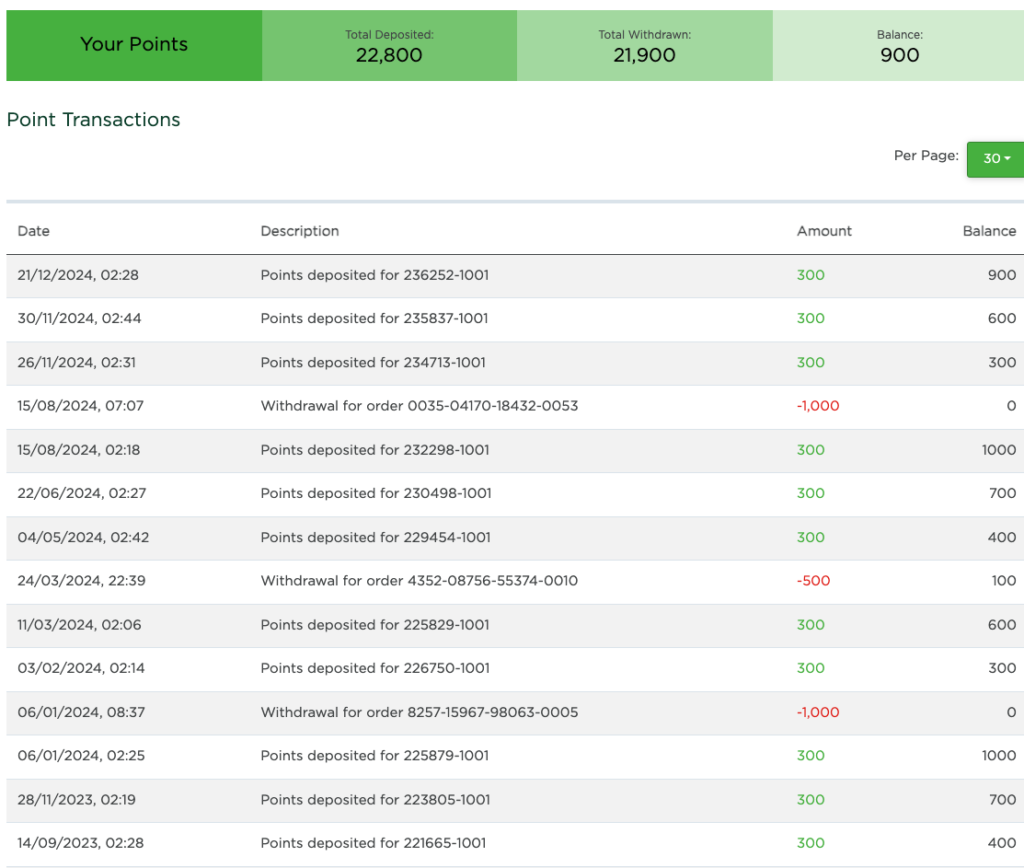

My Personal Experience: Earning 21,900 Points

One of the things I love about Pinecone Research is how quickly the points add up. So far, I’ve earned an incredible 21,900 points, which translates to £219.00 (since 1,000 points equals £10.00). I have cashed out in Amazon gift cards. The process was straightforward, and the rewards are reliable. If I can do it, so can you!

How to Join Pinecone Research

As an exclusive platform, Pinecone Research only accepts new members through invitation links. That’s where I come in—and here’s the exciting part:

I’m offering a number of invitations to join Pinecone Research!

Be among the first to sign up using my special referral link, and you’ll gain access to this incredible platform. But don’t wait too long—spots fill up quickly, and only the first few applicants will be selected.

Tips for Success with Pinecone Research

- Complete Your Profile: Ensure your profile is accurate and complete. This helps Pinecone Research match you with relevant surveys, maximizing your earning potential.

- Stay Active: Regularly check your email or the platform for survey invitations. Respond promptly to avoid missing out.

- Be Honest: Genuine feedback is what brands are looking for. Your honest opinions will keep you in good standing with Pinecone Research.

Start Earning Today

Ready to make your voice heard and get rewarded for your opinions? Click the link below to secure your spot with Pinecone Research. Remember, this is an exclusive opportunity, so act fast to join this elite community of survey takers.

Sign up for Pinecone Research Today

Don’t miss this chance to turn your opinions into earnings. Join Pinecone Research today and start making a difference while boosting your income!